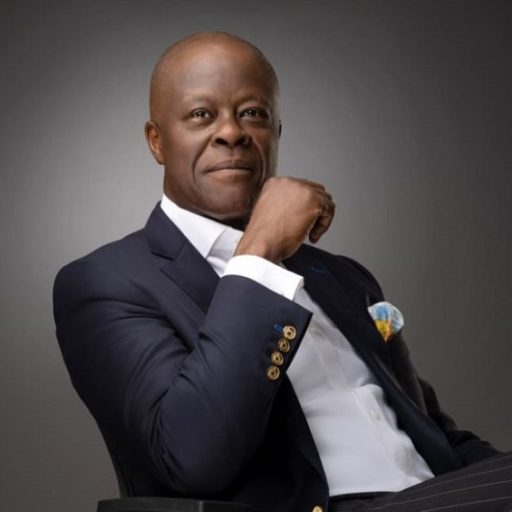

Prof. Barth Nnaji, Chairman of Geometric Power, has urged the Nigerian Electricity Regulatory Commission (NERC) and the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) to address the widening gap between the regulated domestic gas price for power generation and actual market rates.

Speaking at the Oriental News Nigeria 2025 Conference in Lagos on Thursday, Nnaji highlighted the disparity between the official domestic gas price of $2.42 per million British thermal units (MMBtu).

He said that the tariff was recently revised downward by NMDPRA to $2.13/MMBtu as of April 1, and the prevailing market prices that range from $2.70 up to $9/MMBtu depending on supply conditions and contract terms.

“This is ecause most electricity generation depends on gas sourced heavily from the open market, this pricing gap continues to strain the sector,” he said.

Nnaji warned that this disconnect worsened liquidity challenges within the power industry, contributing significantly to the N1.1 trillion electricity subsidy recorded in the first half of 2025.

According to him, it also amounted to trillion-naira debt owed to generation companies (GenCos) by the federal government.

“The gas-to-power benchmark being below actual market realities places an unsustainable burden on power producers,” he added.

He also stressed the urgent need for more cost-reflective electricity tariffs that adequately cover the operational and maintenance (O&M) costs of GenCos, especially as many critical inputs are imported and priced in U.S. dollars.

“The energy charge component of the tariff must cover asset maintenance costs. Without the ability to recover dollar-denominated O&M expenses, recurring system failures are inevitable.

“The regulator must continue adjusting tariffs in line with real industry costs to ensure sustainability,” Nnaji explained.

Expressing concern over Nigeria’s underutilisation of its vast gas reserves, Nnaji pointed out that in spite of proven reserves exceeding 200 trillion cubic feet (Tcf), the country struggles to supply adequate gas to power plants.

“It’s perplexing that NLNG’s Train-7 isn’t running at full capacity due to feedgas constraints. This contradiction puzzles many,” he remarked.

He recalled Nigeria’s previous reliance on coal and a functioning mining industry, lamenting the abrupt abandonment of these alternatives without proper transition planning.

Looking ahead, Nnaji emphasised that while hydro and solar power have roles to play, gas-fired power plants will remain Nigeria’s dominant electricity source for the next one to two decades.

“Hydropower’s limitations include seasonal variability and geopolitical challenges, especially due to dependencies on northern communities and neighboring countries,” he noted.

Nnaji further highlighted Nigeria’s inadequate investment in gas production and pipeline infrastructure, calling for stronger private sector involvement.

“Nigeria has the capacity; the government should be an enabler while the private sector leads. Without sufficient gas production, promising initiatives like compressed natural gas (CNG) adoption won’t succeed,” he said.

He also underscored the erratic operation of gas-fired plants caused by inconsistent gas pressure and supply, an unacceptable situation for a gas-rich nation.

“Reliable gas supply could stabilize Nigeria’s economy and enable expansion into petrochemical and industrial processing, fostering a diversified energy ecosystem,” Nnaji noted.

Commenting on Enugu State’s decision to reduce electricity tariffs for Band A customers, Nnaji cautioned that states assuming regulatory control must be financially prepared to subsidise electricity.

He, however, warned, service disruptions wre inevitable without adequate funding.

“If states assume regulatory control under the Electricity Act, they must be ready to fund subsidies directly or face service disruptions,” he warned.

Nnaji questioned the assumptions behind the current tariff framework, where distribution companies (DisCos) are expected to supply power at N45/kWh based on presumed federal subsidies through the Nigerian Bulk Electricity Trading Plc (NBET).

“There is a misconception that the federal government consistently subsidizes power purchases.

“This isn’t always the case, contributing to the over N5.2 trillion debt owed to GenCos,” he explained.

He also raised concerns over inconsistent Aggregate Technical, Commercial, and Collection (ATC&C) loss remittances by DisCos, which impact liquidity.

“Some DisCos remit as little as 30 per cent of power received, while others remit up to 60 percent. This disparity affects market liquidity,” he noted.

Finally, Nnaji stressed the importance of enforceable Power Purchase Agreements (PPAs) and addressing challenges such as vandalism and operational disruptions that hinder gas supply and power offtake.

“Without consistent gas supply and sound market design, PPAs cannot deliver expected results,” he concluded.

Leave a Reply